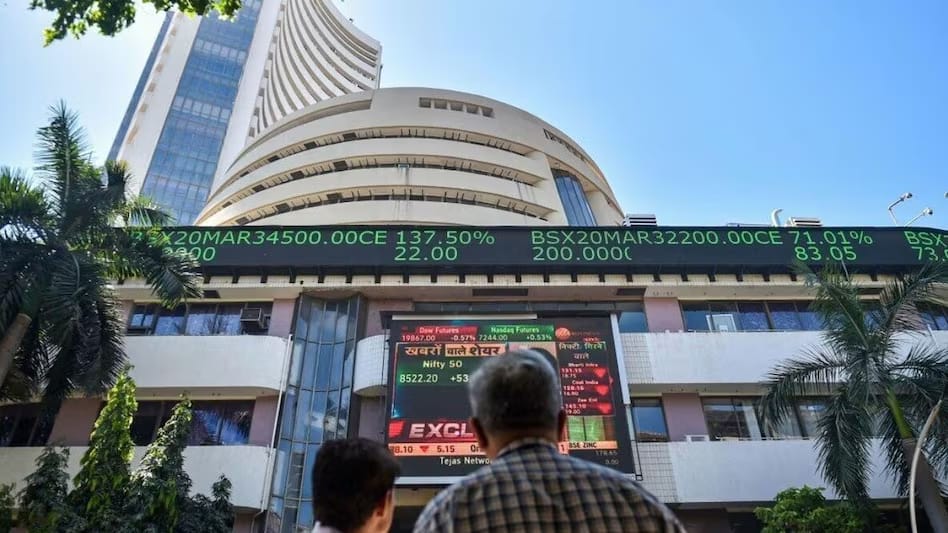

The India stock market has long been an attractive option for investors looking to tap into the potential of one of the fastest-growing economies in the world. However, recent times have proven challenging for investors as India’s Stock Market experiences a prolonged period of stagnation. A key factor behind this flat performance is the ongoing US-China trade dispute, a global issue that is creating significant uncertainty across markets worldwide.

Both the US and China have been at odds over trade practices, tariffs, and intellectual property concerns. As the two largest economies in the world engage in trade wars and negotiation standoffs, their actions are sending shockwaves through the global economy, and India’s Stock Market is no exception. Investors are often cautious in times of geopolitical tension, leading to a subdued performance in markets such as India’s.

In this blog, we’ll dive deeper into the ongoing trade tensions between the US and China and explore how these global factors have impacted India’s Stock Market. We’ll also examine how sectors in the Indian market are being affected, discuss the government’s role in managing the economic effects, and provide practical advice on how investors can weather the uncertainty. BestPrimeNews

The US-China Trade War: A Global Ripple Effect

To understand the impact of the US-China trade dispute on India’s Stock Market, we first need to look at the origins and scope of the trade war itself. The US-China trade war began in earnest in 2018 when the United States, under the leadership of former President Donald Trump, imposed tariffs on Chinese goods, citing concerns over unfair trade practices, intellectual property theft, and trade imbalances. In retaliation, China imposed tariffs on American goods, escalating the dispute into a full-blown trade war.

The standoff has led to disruptions in global supply chains, shifting of manufacturing bases, and significant price hikes for various products. While both the US and China have seen economic challenges as a result of the dispute, the global economy as a whole has been adversely affected. This trade war has had a ripple effect across international markets, and emerging economies like India are feeling the pressure.

How the US-China Trade Dispute Affects India Stock Market

India is intricately connected to the global economy, especially when it comes to trade and investment. While India is not directly involved in the US-China trade dispute, the repercussions of the conflict have reverberated through the India Stock Market. Here are some of the primary ways in which the US-China trade tensions affect India’s Stock Market:

1. Foreign Investor Sentiment

One of the primary ways in which global events like the US-China trade dispute affect India Stock Market is through foreign investor sentiment. India’s financial markets are open to foreign portfolio investments (FPI), and these investors are highly sensitive to global economic conditions. When tensions rise between major economies like the US and China, foreign investors tend to retreat to safer investments, such as government bonds or gold. This flight to safety often results in reduced inflows into equity markets, including India’s.

In the case of the US-China trade dispute, foreign investors are concerned that the economic fallout from the trade war will lead to slower global growth, reduced demand for goods and services, and increased market volatility. As a result, foreign investors have been hesitant to invest in riskier assets, which in turn affects the liquidity and performance of India Stock Market.

2. Impact on Indian Exports

India is a significant player in global trade, with its export-oriented industries contributing heavily to the economy. Key sectors such as textiles, electronics, chemicals, and pharmaceuticals rely on exports to countries like the US and China. However, the trade war between these two countries has disrupted global supply chains and affected trade flows, which in turn impacts India’s export sector.

For instance, the imposition of tariffs on Chinese goods has made Chinese products more expensive in international markets, which has led some countries to seek alternative suppliers. This creates an opportunity for Indian exporters to fill the void in certain markets. On the other hand, India’s exporters also face challenges due to the reduced demand for global products as a result of economic slowdowns caused by the trade war.

While some Indian exporters may benefit from a shift in supply chains, others are being hurt by reduced demand from countries affected by the US-China tensions. As these challenges affect the financial performance of Indian companies, the stock prices of these firms may take a hit, contributing to the overall flat performance of India Stock Market.

3. Commodity Price Fluctuations

India is a major importer of commodities such as oil, natural gas, and metals. The prices of these commodities are heavily influenced by global demand and supply dynamics, which are in turn shaped by geopolitical events. When global trade tensions rise, it often leads to a slowdown in economic activity, reducing the demand for commodities. As the demand for oil and metals weakens, commodity prices tend to decline.

For India, this can be a double-edged sword. On one hand, lower commodity prices can benefit Indian companies that rely on imports of raw materials. On the other hand, falling oil prices can hurt energy companies in India, which are a significant part of the India Stock Market. The energy sector’s poor performance, combined with weaker global growth projections, can contribute to the flatness of India’s Stock Market.

4. Currency Volatility and Inflationary Pressures

The Indian Rupee (INR) is not immune to the effects of global trade tensions. As investor sentiment worsens due to concerns about the US-China trade war, capital flows into emerging markets such as India may slow, leading to a depreciation of the rupee. A weaker rupee can make imports more expensive, putting upward pressure on inflation in India.

For Indian companies that rely on imported goods, a weaker rupee means higher costs, which can reduce profitability and affect stock prices. Furthermore, higher inflation can erode the purchasing power of consumers, leading to reduced demand for goods and services, further impacting India Stock Market.

5. Geopolitical Tensions and Market Volatility

The US-China trade war has created significant geopolitical tension, not just between the US and China but also among other global powers. As trade relations become increasingly strained, markets around the world experience heightened uncertainty. Investors tend to shy away from markets in times of geopolitical risk, and India Stock Market is no exception.

Volatility in global markets often triggers a “risk-off” sentiment, where investors liquidate their holdings in emerging markets like India in favor of safer assets. As foreign investors reduce their exposure to India, local investors may follow suit, further exacerbating market declines.

India’s Stock Market: A Mixed Bag of Opportunities and Risks

Despite the global uncertainties, India Stock Market continues to offer potential opportunities for investors. While there are certain challenges caused by the US-China trade dispute, there are also areas of growth and resilience within the Indian economy. Here’s a closer look at the current state of India Stock Market:

1. Strong Domestic Demand

One of the driving factors behind India’s long-term economic growth is its strong domestic demand. Unlike many developed economies, India has a large and growing middle class that is increasingly consuming goods and services across various sectors, including retail, real estate, and healthcare. This domestic demand provides a buffer against external shocks, as Indian companies can rely on local consumption to fuel growth.

While global uncertainties can weigh on export-driven industries, companies catering to domestic demand are better positioned to weather the storm. Sectors like consumer goods, banking, and pharmaceuticals remain strong contenders in India Stock Market, even in times of global turbulence.

2. Government and RBI Policy Support

The Indian government has been proactive in addressing the challenges posed by global trade tensions. Through fiscal stimulus measures, the government has worked to support key sectors like infrastructure, manufacturing, and agriculture. These initiatives aim to stimulate economic growth and create jobs, which could have a positive effect on India Stock Market.

In addition, the Reserve Bank of India (RBI) has taken steps to ensure liquidity in the economy. With interest rate cuts and other monetary policy measures, the RBI has sought to boost credit growth and consumer spending, both of which can support stock market performance.

3. Technological Advancements and Innovation

India Stock Market is also benefiting from rapid advancements in technology. The country is home to a thriving tech industry, with companies in sectors like software services, e-commerce, and digital payments experiencing strong growth. As India continues to embrace digital transformation, these sectors are likely to see increased investor interest.

The rise of technology-driven companies also provides opportunities for investors to tap into high-growth sectors, even as other areas of the economy face challenges due to global trade tensions.

How Should Investors Navigate These Times?

Given the uncertainty surrounding India Stock Market due to the US-China trade dispute, many investors are unsure of how to proceed. Here are some strategies to consider:

1. Diversification

Diversification is key to managing risk in uncertain times. By spreading investments across different asset classes, sectors, and geographies, investors can reduce the impact of any single market event. A diversified portfolio can help investors weather market volatility while capturing growth in sectors that are less affected by global tensions.

2. Focus on Long-Term Goals

It’s important for investors to maintain a long-term perspective when navigating a volatile market. While short-term fluctuations may be unsettling, India’s economic India Stock Market fundamentals remain strong, and the country’s long-term growth prospects are promising. By focusing on long-term growth potential, investors can stay calm and make informed decisions despite market volatility.

3. Monitor Global and Domestic Developments

Keeping track of global developments, particularly regarding the US-China trade dispute, can help investors make more informed decisions. It’s also crucial to monitor domestic factors such as government policy changes, RBI actions, and corporate earnings reports, as these will influence the performance of India Stock Market.

4. Consult a Financial Advisor

For those unsure about their investment strategy, consulting a financial advisor can provide valuable insights. A professional can help tailor an investment plan based on individual risk tolerance and financial goals, ensuring that investors are better equipped to navigate the uncertainty.

Conclusion

The US-China trade dispute has created a period of uncertainty for India Stock Market, leading to a flat performance in recent months. While global tensions continue to pose risks, India’s strong domestic demand, government policies, and technological advancements provide opportunities for long-term growth. By diversifying their portfolios and maintaining a long-term perspective, investors can better navigate the challenges ahead.

India Stock Market may be facing a period of stagnation, but the country’s robust economic fundamentals and growing sectors make it an attractive market for those willing to weather the storm. By staying informed, diversifying investments, and focusing on long-term goals, investors can position themselves for success as the global economic landscape evolves. BestPrimeNews